Failed payments

Churn

Why Payment Failures Happen

Jake Vacovec

Dec 16, 2024

For subscription-based businesses, payment failures are more than just an inconvenience—they’re a silent revenue killer. Every failed transaction can lead to involuntary churn, leaving customers disconnected and businesses scrambling to recover lost revenue. At FlyCode, we understand the stakes and the solutions. In this guide, we’ll dive into why payment failures happen and how FlyCode helps you rescue failed payments while enhancing your customer experience.

Why Payment Failures Happen

Payment failures occur for a variety of reasons, and understanding these can be your first step toward reducing their impact. Here are the most common culprits:

Insufficient Funds Customers might not have enough balance in their account when the subscription charge is attempted.

Expired Cards Credit card expiration dates often sneak up on customers, causing payments to fail.

Card Limits Some customers may reach their card’s spending limit or have restrictions on recurring transactions.

Technical Issues Network glitches or errors in payment gateways can interrupt the transaction flow.

Fraud Prevention Blocks Banks and card issuers sometimes block transactions they perceive as suspicious, even if they’re legitimate.

Customer Neglect Customers might forget about a pending charge or overlook the need to update their payment details.

The Cost of Ignoring Payment Failures

While a single failed transaction may seem negligible, the cumulative impact can be staggering.

Lost Revenue: Every failed payment is potential revenue left on the table.

Churned Customers: Frustrated customers may abandon your service altogether if the payment process feels cumbersome.

Operational Overhead: Manually tracking and retrying failed payments can drain your team’s time and resources.

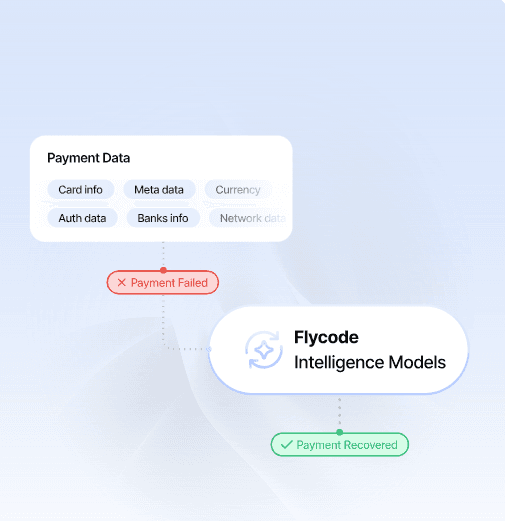

How FlyCode Solves Payment Failures

At FlyCode, our mission is to turn failed payments into retained customers. Here’s how we do it:

1. Intelligent Retry Logic

Our platform uses advanced algorithms to optimize the timing and method of payment retries. For example, we analyze patterns in customer behavior to ensure retries are timed for when the customer is most likely to have sufficient funds.

2. Alternate Payment Methods

FlyCode automatically detects and charges alternative cards on file when the primary card fails. This seamless feature ensures minimal disruption for your customers.

3. Real-Time Notifications

We provide real-time alerts and proactive messaging to keep customers informed about their payment status, offering them convenient options to update their details.

4. Customizable Dunning Campaigns

Our solution includes tailored communication strategies to re-engage customers. Polite and helpful reminders via email or SMS are crafted to increase the likelihood of recovering failed payments.

5. Analytics and Insights

FlyCode offers detailed reports on payment failures, success rates, and customer retention, empowering you to make data-driven decisions to further optimize your payment process.

6. Seamless Integration

We’ve built FlyCode to integrate effortlessly with major payment gateways like Stripe. Whether you’re scaling or just starting, our platform fits your needs.

What Makes FlyCode Different?

Unlike generic solutions, FlyCode leverages advanced machine learning and predictive analytics to revolutionize payment recovery. Our technology dynamically adapts retry strategies based on historical transaction patterns and customer behavior. Our founders’ extensive experience in building fintech infrastructures has enabled us to design a system tailored to address complex subscription-based challenges, including real-time payment optimization and enhanced fraud prevention.

Here are some ways FlyCode stands out:

Payment Anomaly Detection: FlyCode employs advanced anomaly detection algorithms to identify irregular payment patterns in real-time. By proactively flagging potential issues such as fraud, system errors, or unusual customer behavior, we enable businesses to address problems before they escalate, ensuring a smoother payment experience and safeguarding revenue streams.

Proactive Problem Solving: Beyond retries, we actively work to prevent future failures by identifying patterns and optimizing processes.

Flexibility: From startups to enterprises, our solution scales with your business.

Actionable Tips to Reduce Payment Failures

While FlyCode’s platform is your best ally, here are additional steps you can take to mitigate payment failures:

Educate Customers Proactively remind customers to update their payment details, especially before card expiration dates.

Offer Multiple Payment Options Allow customers to choose from various payment methods to reduce reliance on a single card.

Leverage Subscription Analytics Use insights to predict and prevent churn by addressing issues early.

Invest in Secure Payment Systems Ensure your payment gateway has robust fraud prevention mechanisms without creating friction for legitimate transactions.

Ready to Save More Revenue?

Payment failures don’t have to be a dead end. With FlyCode, you can recover lost revenue, retain more customers, and build a seamless payment experience that strengthens your business.

Get in touch with us today to see how FlyCode can transform your payment recovery strategy. Let’s make every transaction count!