Stripe

Subscription

involuntary churn

Gal Cegla

Nov 14, 2024

In a new report from Stripe billing, they highlight trends and insights from more than 2,000 subscription business leaders from around the world. Stripe are sharing that churn continues to be a looming concern, with 72% of survey respondents saying they are worried about churn impacting their bottom line.

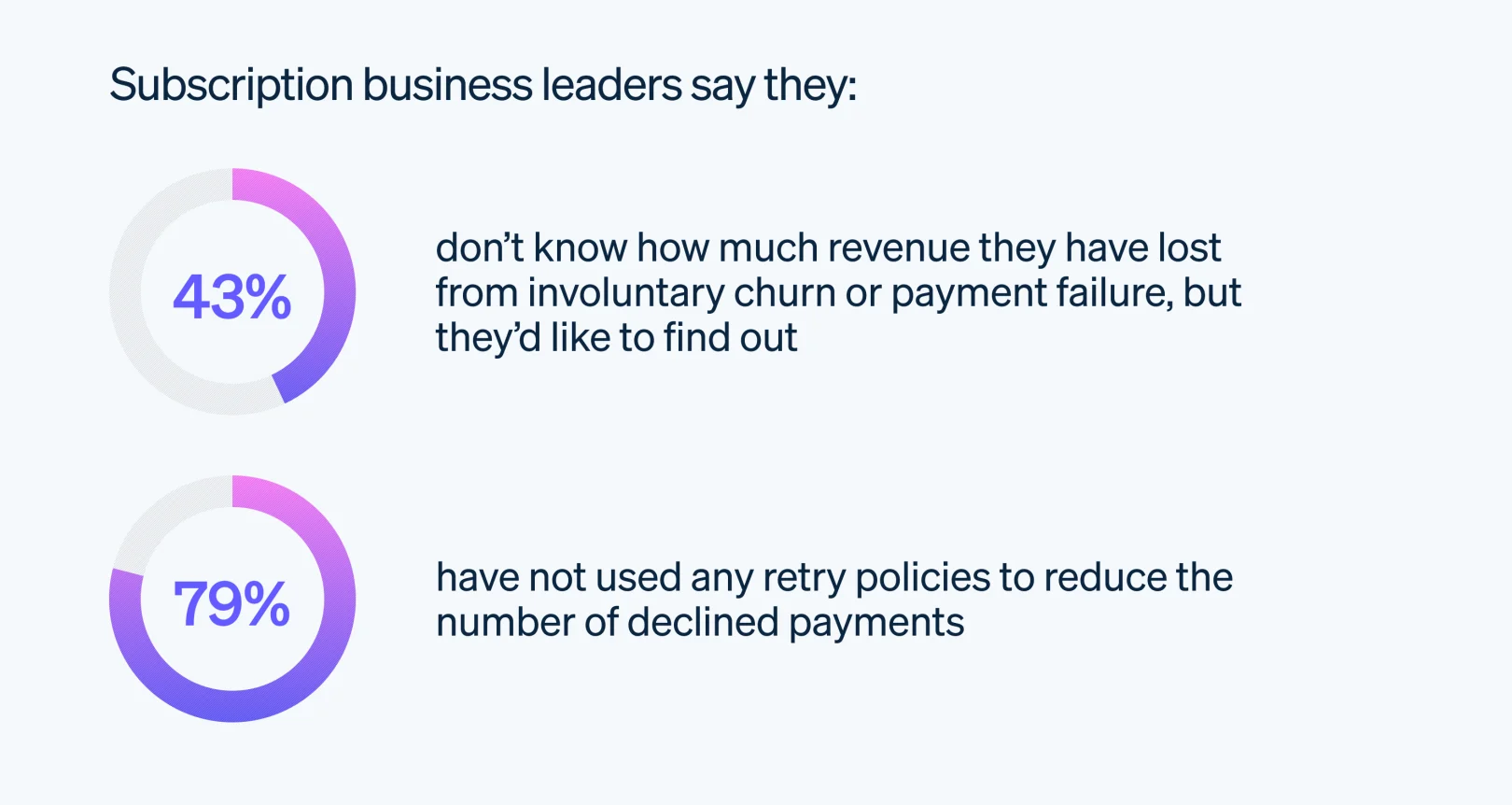

Involuntary churn has become one of the most common concerns we hear from business leaders. However, many of them lack the information they need to understand its impact on revenue or don't introduce strategies to reduce it, such as retry policies.

Billing systems should provide accurate revenue metrics and financial health information to businesses. Stripe data shows that when a monthly subscription is recovered after involuntary churn, it typically lasts another seven months.

The Hidden Cost of Churn

For any subscription model, churn isn’t just a statistic—it’s a critical metric with direct ties to the bottom line. Voluntary churn, when customers consciously decide to cancel, is often unavoidable. However, involuntary churn—when customers are dropped because of failed payment attempts or outdated card details—presents an opportunity. Addressing involuntary churn effectively can recapture a substantial revenue stream without needing new customers. Unfortunately, traditional recovery methods have proven insufficient, leading businesses to lose out on substantial recurring revenue.

Why Current Solutions Fall Short

Many companies use a blend of email reminders, billing retries, and customer outreach to address involuntary churn. However, these approaches often lack the precision and timing needed to truly reduce churn rates. A failed transaction can lead to a cycle of repeated, unsuccessful retries, which not only strains customer relations but also impacts the success rate of future payments. Companies need smarter, tech-driven solutions that not only remind customers of failed payments but also anticipate and prevent them.

Advanced Solutions for Tackling Involuntary Churn

Today, advanced solutions are emerging that enable subscription businesses to intelligently and automatically manage payment issues, reducing friction for customers and minimizing lost revenue. With machine learning algorithms, companies can predict failed transactions before they happen, preemptively request updated payment information, and customize retry schedules based on customer payment patterns. These intelligent systems are significantly more effective than standard retry attempts, as they are tailored to each customer’s behavior.

The Future of Subscription Revenue Management

As customer expectations rise, businesses that proactively manage payment issues and minimize disruptions in their service will gain a significant edge. Reducing involuntary churn doesn’t just mean fewer failed payments; it means stronger customer loyalty, higher retention, and a more reliable revenue stream. By embracing smarter, more responsive solutions to involuntary churn, subscription businesses can secure lasting relationships with their customers while supporting their own long-term growth.