Gartner

Recurring Billing

Stripe billing

TD

Sep 16, 2024

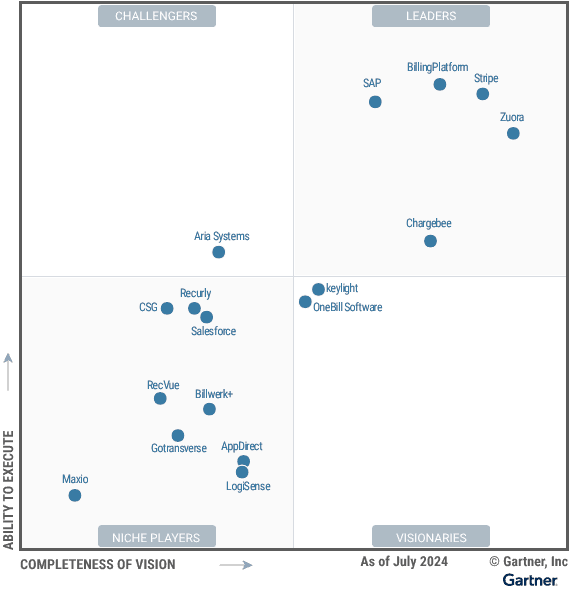

In August 2024, Gartner’s Magic Quadrant for Recurring Billing Applications evaluated 17 key vendors offering SaaS billing solutions for subscription models. With an emphasis on automation, usage-based billing, and compliance with global accounting standards like IFRS 15 and ASC 606, these tools are mission-critical for businesses dependent on recurring revenue streams.

Market Definition/Description by Gartner

A recurring billing application enables organizations to bill customers for one-time, subscription-based and usage-based fees for goods and services. It consumes orders and/or service contracts documenting the goods and services the customer has purchased, periodically generates fixed recurring fees, and ingests and rates product usage data. It issues one-time or periodic roll-up invoices to the customer and collects payments before determining recognizable revenue and posting to an external general ledger. APIs or UI fragments support a self-service billing portal. Modern recurring billing applications are an important customer touchpoint for measuring customer sentiment and for delivering marketing messaging.

Recurring billing is mission-critical for invoicing customers and collecting revenue for a business. It ensures billing for all goods and services is aggregated into one periodic invoice to the customer. It enables value-based pricing models that are charged based on actual usage of the service. Payment can be automatically collected by a wide range of payment mechanisms. Dunning workflow optimizes the collection of failed or delinquent payments. Revenue recognition logic ensures adherence to the latest international standards such as IFRS 15 and ASC 606.

Figure 1: Magic Quadrant for Recurring Billing Applications

Recurring Billing Market Overview

In 2023, the recurring billing market generated approximately $5 billion, with only $1 billion attributed to modern SaaS vendors included in Gartner's report. The remaining revenue came from traditional, on-premises vendors serving industries like telecommunications, financial services, and utilities. Gartner anticipates that cross-industry SaaS solutions will disrupt these sectors with more affordable and innovative products. While the consumer and tech subscription markets may be nearing saturation, new growth for SaaS vendors will come from replacing expensive legacy systems, possibly shrinking the overall market as these efficient solutions gain traction.

There are more than 240 vendors in the recurring billing applications market, and the vast majority did not meet the inclusion criteria for this Magic Quadrant.

The majority of the 240 vendors in this market have less than $10 million in annual revenue. A recurring billing deployment is for the long term. Often, these systems are used for 20 or 30 years. Vendor viability is therefore a significant factor in our Ability to Execute score. This report excludes vendors with less than $10 million in revenue or with no sales growth.

Read the full report: https://www.gartner.com/doc/reprints

FlyCode and the Subscription Billing

At FlyCode, where we help subscription companies recover lost revenue due to failed payments, understanding these billing systems ensures our solution integrates seamlessly into leading platforms, enhancing recovery efforts and optimizing revenue retention strategies. By staying ahead of market leaders, we provide our clients with cutting-edge insights for superior revenue retention.

You can learn more on our payment partners here: https://www.flycode.com/connections

FlyCode’s focus on recovering revenue from failed payments complements the robust features of these billing solutions, offering a full-circle approach to reducing churn and enhancing customer lifetime value.