Wordtune

AI

Failed payments emails

Gal Cegla

Jan 12, 2025

One of the top AI companies in the world sent me 16 emails about failed payments. Several at once. We use the product every day, it's one of the best companies out there... and I'm a huge fan But apparently, failed payments were overlooked or at least not optimized for recovery In the last year [FlyCode](https://www.linkedin.com/company/flycodehq/) run automated payments audit for 350+ of the top SaaS and AI companies in the world $$$$ In the audit, we show you how much money you are losing, the ARR lost, and the impact of churn from failed payments. It blows the minds of 95% of teams to see the numbers from their own data Crazy You'll be surprised at how much money they leave on the table In spite of the fact that they considered every aspect of their product, they left a leaky bucket of failed payments and involuntary churn - It’s a bad customer experience - They are losing millions of dollars every month (the full LTV of your customers). - And it’s a huge churn problem

How Wordtune by AI21 is dealing with failed payments? Lessons for Every Subscription-Based Business

Wordtune is an AI-powered paraphrasing tool and reading and writing assistant that can correct spelling and grammar and switch between formal and casual tones. The company was founded in 2017 and launched on October 2020. Wordtune raised $283 million, values the company at $1.4 billion.

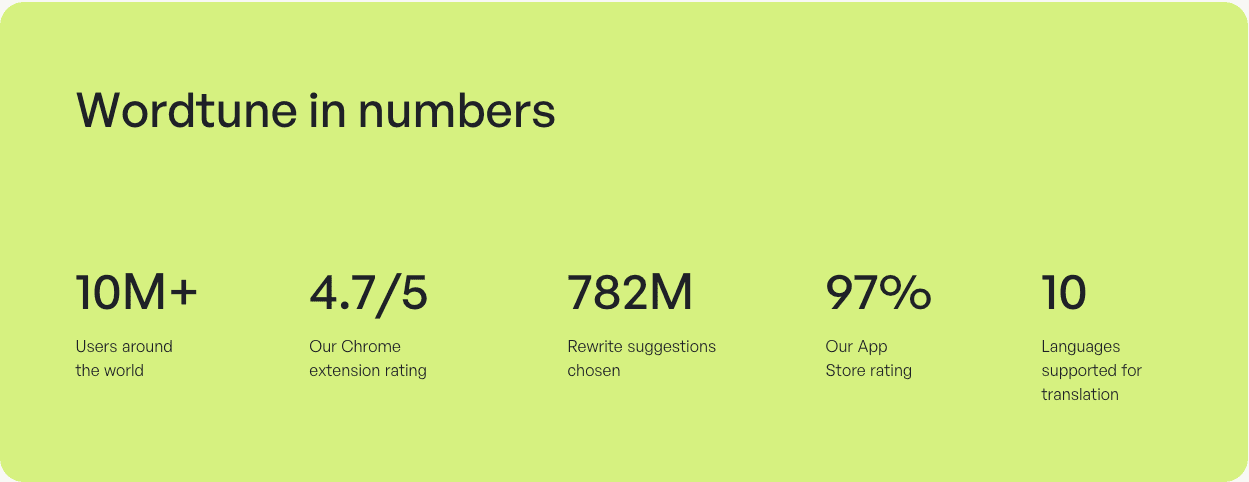

Wordtune numbers

Wordtune by AI21 Labs, an AI writing assistant, has been using Stripe Payments to process customer payments since 2020. With over 10 million users and two million active monthly users, Wordtune faces failed payments like any scaled up subscription or SaaS company.

Wordtune failed payments challenges

Wordtune faces the same challenges around failed payments as many B2C (and B2B) subscription companies. To mitigate failed payments in the future, Wordtune needed to identify the underlying causes.

🎟 What causes payment failures and involuntary churn?

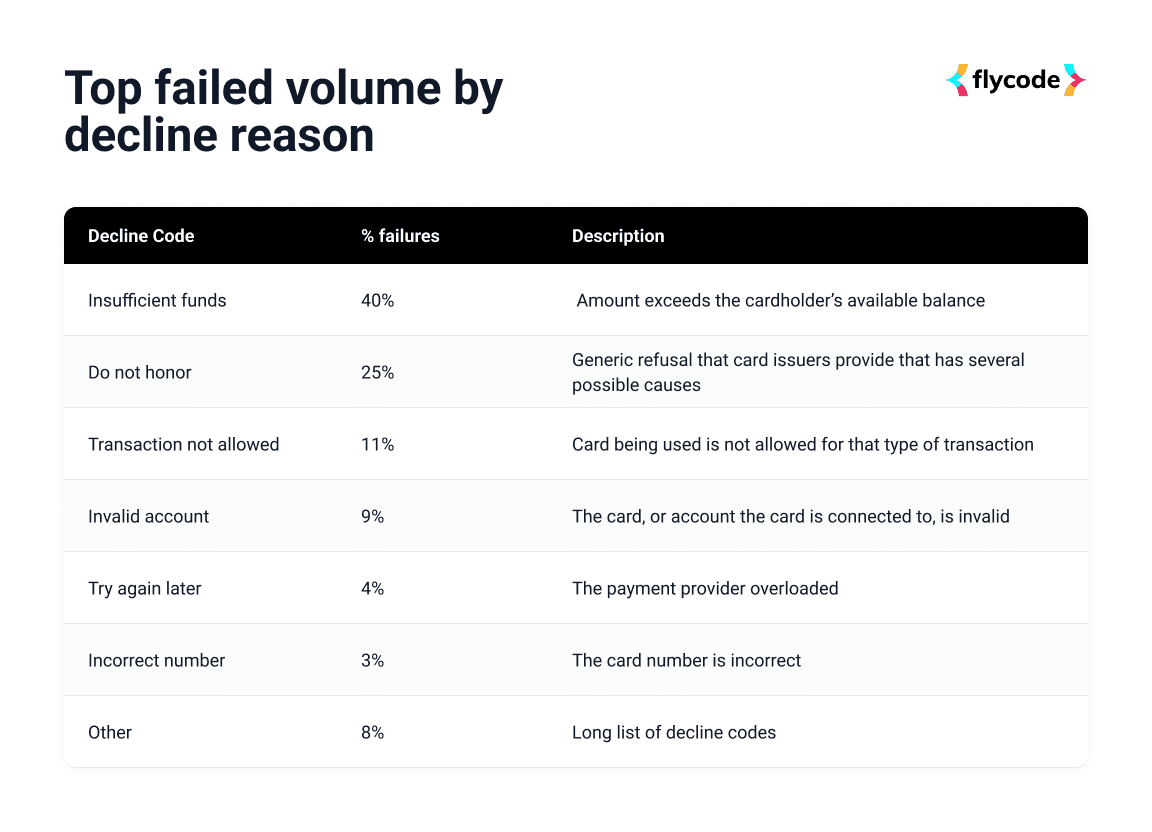

There’s no single cause of this problem that can be isolated. In fact, there are dozens of reasons [insufficient funds, fraud, expired cards, AVS, SCA, invalid card, etc.], and solutions to each failure need to be applied individually. Let’s look at a few examples:

Batch Processing and Fixed-Interval Retries. The majority of subscription payments and retries are processed in bulk during off-hours. If your customers are based in multiple time zones, this can increase payment failures and reduce the success rate of retries. Remember when you had to notify your bank when you were traveling? The concept is the same, a 3am charge is more likely to get flagged as fraud than a 9am charge.

Expired Cards or Invalid Card Numbers: These are frustrating because you think you have to ask your customers to do something, surprisingly there are many cases when you don’t. When you lose a credit card and replace it, do you ever wonder how Netflix still manages to charge you? It’s all thanks to Card Account Updater and Network Tokenization — if you don’t have it implemented, it’s an easy win.

Customers with Insufficient Funds: Timing is a critical factor, especially with these types of errors. If they don’t have funds, don’t force it. When retry attempts are spread out or targeted around periods of the month when cash inflow is expected, success rates will go up.

Payments that are incorrectly classified as fraud: This can cause financial losses, as well as a negative impact on customer experience. It is important to prevent those legitimate payments from failing.

One of the biggest challenges is that payment providers, issuing banks, and card networks do not have unified error codes. Each may have errors classified into different categories, which adds complexity and leads to many errors getting bucketed together, such as ‘Do not honor’. Here are some of the common decline codes:

How does Wordtune handle failed payments?

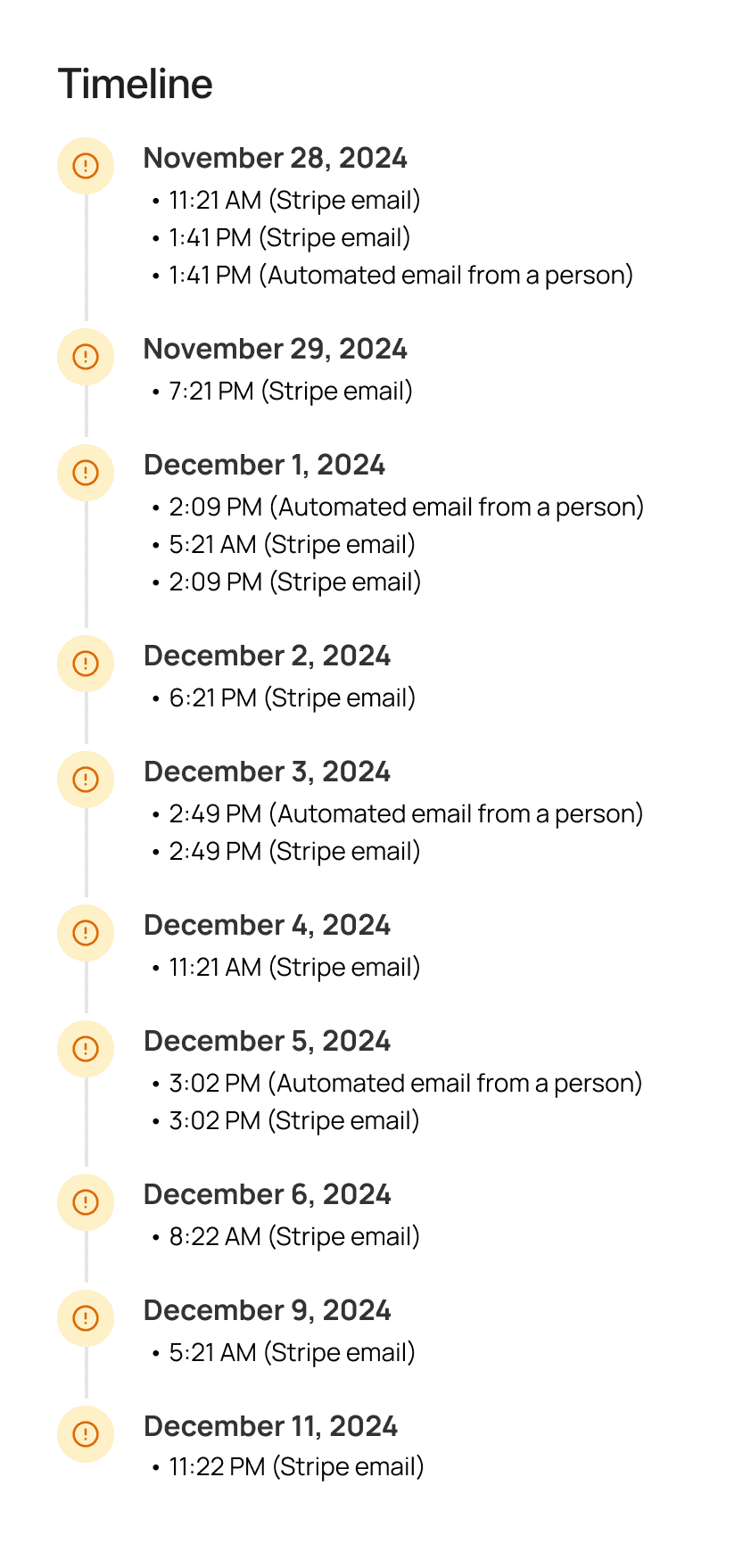

We got 16 emails about failed payments from Wordtune

This is the email scheduled we received:

It’s always surprising to see how the best products in the world are still struggling with failed payments retries and outreach. The best payment optimization will try to recover payments with:

(1) the least number of retries

(2) as quickly as possible

(3) with the fewest customer communications.

In this case study we will show an annual subscription.

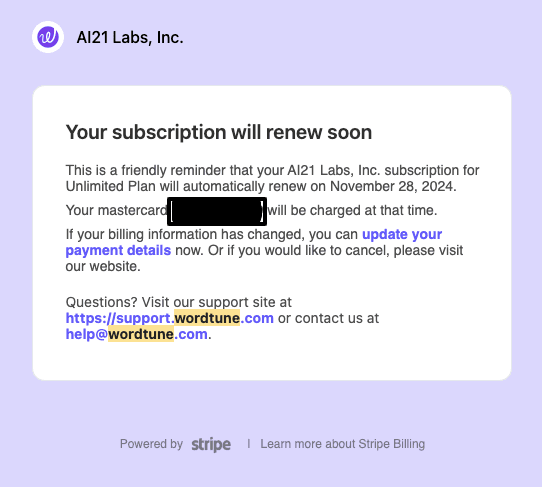

Email reminder for an Annual subscription

Two weeks before the subscription expires, the first email is sent. This email is triggered from Stripe:

Wordtune has a great best practice here. Let’s deep dive on why this is important why Annual subscriptions tend to cause more failed payments than monthly subscriptions.

Why Annual subscriptions tend to cause more failed payments ?

Higher Payment Amounts Annual subscriptions typically involve larger, lump-sum payments. This increases the likelihood of the transaction exceeding the customer’s credit limit or available funds.

Card Expiry and Updates Over the course of a year, customers' payment cards may expire, get replaced due to fraud, or change due to account updates. When the annual renewal comes up, the stored card details may no longer be valid.

Customer Forgetfulness Customers often forget they signed up for an annual subscription, especially if there was no reminder before renewal (Wordtune did send a reminder as you can see below).

Bank Declines for Large Transactions Banks may flag large, infrequent transactions as potentially fraudulent.

Reduced Payment Recency With monthly subscriptions, customers are more regularly engaged in a payment cycle. Annual subscriptions create a long gap since the last transaction.

Weaker Customer Retention Reason: Customers with annual subscriptions may feel less committed over time. They might not want to renew or resolve payment issues if they've lost interest in the product/service.

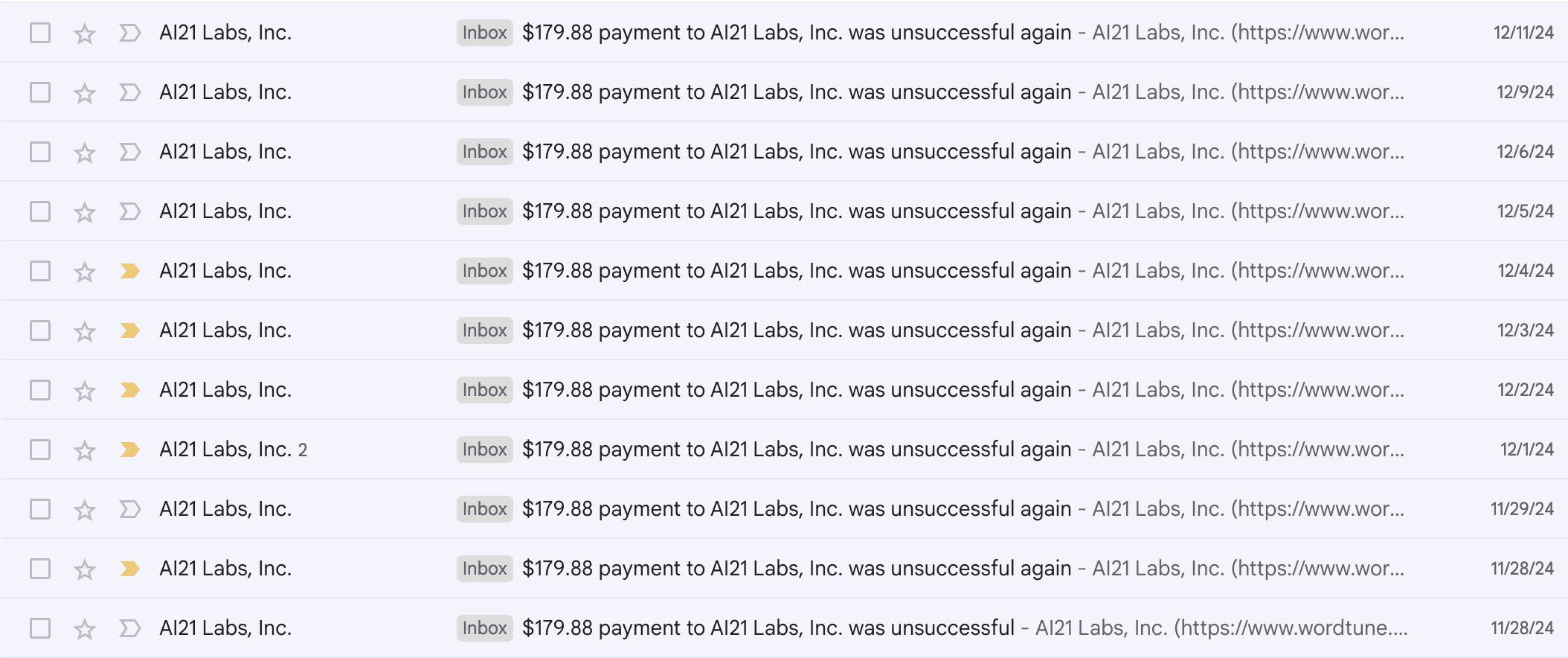

The 16 emails breakdown

12 are sent from Stripe - all look the same

Wordtune's email schedule shows that they sent 12 emails from Stripe that look like this:

The schedule from Stripe looks like this:

What can we learn about the emails?

Same sender

Same headline

Same email

Same CTA

Not personalised

Not optimized to my local time or the error code

When you reply to the emails, they email will go to help@wordtune.com

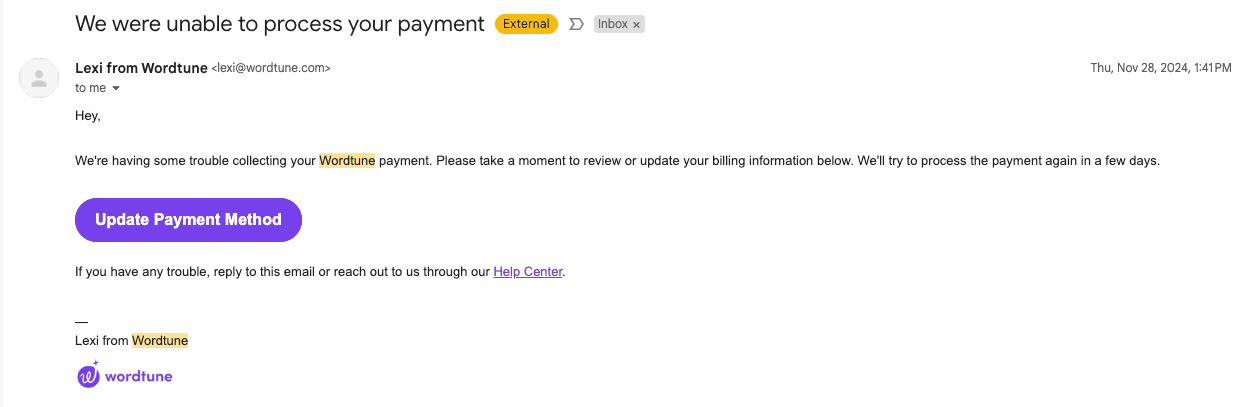

4 are automated emails from the same person with a CTA

Another 4 automated emails from the same person that look more custom look like this:

What can we learn about the emails?

Same sender

Have similar headlines

Slightly different content

Link to the help center https://support.wordtune.com/en/

CTA to “Update Payment Method”

Sending 16 emails about failed payments is excessive and can create a negative customer experience. These emails, often categorized as transactional emails, typically cannot be unsubscribed from, leaving the user feeling overwhelmed or frustrated. Bombarding customers with such a high volume of emails increases the likelihood of email fatigue, where users disengage or ignore future communications. Additionally, it raises the risk of spam complaints, damaging the company’s sender reputation and email deliverability. A more balanced approach—such as sending fewer, strategically timed emails—can improve effectiveness while maintaining a positive customer relationship.

What are the main challenges with failed payments emails?

emails that aren’t read immediately and if already recovered it hurts the customer experience

sending emails shifts the problem to your customer instead of trying to recover the payment, before sending emails

and most importantly it increases the risk that your customer will actively cancel and churn because of a failed payment (we refer to this motion as ‘Passive to Active’ or ‘Involuntary to Active’ churn).

For specific error codes, the suggestion is to hold off on communications for a few days until you’ve tried to recovered the payment. The best option is to coordinate the communications with the retries automatically for each customers payments and why they’re failing.

Failed payments impact

Failed payments present a significant challenge for Wordtune and other businesses with subscription-based models or recurring revenue streams. The issues arise from multiple factors:

1. Customer Churn

Involuntary Churn: When a payment fails, customers may unintentionally lose access to a service. If the issue isn’t resolved quickly, they might not return.

Loss of Lifetime Value: Losing a customer due to a failed payment reduces the total revenue the business could earn from that customer over time.

2. Revenue Leakage

Failed payments mean immediate loss of revenue. If not recovered, this can substantially impact a company’s bottom line.

3. Complexity of Recovery

Retry Logic: Payment gateways provide basic retry mechanisms, but optimizing retry timing and frequency requires advanced machine learning

Communication: Reaching out to customers effectively without seeming intrusive is a delicate balance.

Payment Methods: solutions like Card Account Updater (CAU) and Network Tokens help to automatically update card details when a new card is activated or an expired one is replaced.

4. High Operational Costs

Resolving failed payments often involves manual intervention, such as customer support calls, which can be time-intensive and expensive.

To address churn and failed payments issues, we suggest to:

Send payment reminders ahead of renewal dates.

FlyCode can help you implement smart retries models to recover failed payments

Use tools like account updater services to keep payment details current.

Send the right emails based on a data model for fewer communication

Get a free payment audit from FlyCode to boost revenue: